Like any other young dude doing his engineering, I started tinkering with the idea of investing stock markets, back in my engineering days. What started as an endeavour to make some quick bucks turned out to be a much more entertaining, fulfilling and learning experience.

Five years of investing is by no means a colossal amount of time in the investing universe. However, I’m still sharing my experiences, learnings and mistakes over this time frame.

Introduction

My investing journey started somewhere in the last weeks of May 2015 by filling out forms and signing out countless times in the application form at Geojit – a broker based out of Kerala. It was my lack of knowledge (at the time) that led me to believe that you needed to be at least 18 years old to get a PAN Card which was necessary for opening a Demat account.

The actual investing process started a few days later when my papers were processed and they have activated my account. On the Wednesday of June 10, 2015, I finally made my very first investment in a relatively unheard company, which I held on for nearly 4 years along with 5 other companies.

Like many others, I made some money, lost some money, made mistakes and did stupid things. But most importantly, learnt a lot during the process. I’ve summarised some of them below, not in any order.

Learnings

Quality first, always

Initial years saw me chasing the so-called “hot stocks” which “seemed like” having huge potential to generate tremendous returns. But I really ended up eroding capital in the process. The argument I had against excellent quality stocks at the time was: This company (share price) is already doing good, so I don’t see much opportunity in it anymore. I wasn’t more wrong. In fact, an elite company has better chances of, say, doubling from the CMP than a cheap but questionable company. Example: Reliance doubling in the past couple of months.

Don’t judge a company by its share price.

A lot of beginners (including me back at the time) make the mistake of judging companies by its share price. You and I make the mistake of thinking say, an HDFC Bank trading at 1200 is expensive. Whereas a Yes Bank trading at 25 is cheap. But one should never gauge a company by its stock price alone. Companies trading at tens of thousands of rupees might be cheap from a valuation perspective when compared to a cheap penny stock trading at expensive valuations.

You cannot time the market

You can often see discussions on “if it is the right time to enter/invest the market or not.” In my experience, there is no right or wrong time, the best time is when you have the means to do it, without trying to time the market. The primary reason one tries to time the market is because of a short investment horizon. If you plan to hold on to a company for years, it doesn’t matter if you buy it today or 2 weeks later at a 2% discount. The issue with trying to time the market is that you never know for sure and you’ll always end up questioning yourself.

Returns come from patience

One of the most overlooked aspect of investing is the investor’s patience. The difference between an average investor and a brilliant investor is the ability of the latter to sit on his investments for interminable periods of time, allowing it to compound. One should also note that sitting blindly on a terrible investment hoping that tides would turn in your favour is also a grave mistake.

The 80/20 Rule in Investing

One of the mistakes early investors makes is to sell their winners and hold on to the losers. Some make it even worse by selling the winners to buy the losers. Even I have been victim to this mentality. The primary reason for such a thought is that one often thinks of an investment as a one time instrument and once a certain return is achieved, we must replace it with another instrument. But the reality is far from it. A fundamentally sound company, with a proven track record, can generate returns year after year.

Stock markets are volatile, and there isn’t much you can do about that.

Stock markets are volatile, it doesn’t work like fixed income assets such as debt or FD. It is also wrong on our part to expect it to behave like one. And more often than not, it takes a toll on you. You’ll definitely be stressed to see wild swings in your portfolio over time. But that doesn’t mean that you must take action or monitor it daily.

To visualize the nature and volatility of markets and expectations, consider the following. A hypothetical price movement of a share from 100 to 200.

Expectations: 100->110->120->130->140->150->160->170->180->190->200

Reality: 100->130->110->96->78->130->155->181->177->186->200

Say, you’ve correctly identified and picked a stock at 100 and know it has the firepower to reach 200. You need genuine conviction to hold on to it when it has corrected 20% just when you bought. And boy does that happen.

Cash is king

Consider the following situation: The markets have corrected heavily, say 20%. You suddenly needed some amount of money for an emergency. If all your savings were invested, with no emergency fund in cash, it would force you to exit at a terrible time. Leaving you with no other option than an untimely exit. Hence, one must only invest in equities after having an emergency fund which can take care of your immediate needs if the case arises.

Also, if you allocate a percentage of your portfolio to be liquid cash, it gives you the opportunity to deploy it at a stage when the market has corrected because of a temporary event. Example: Markets corrected heavily in 2020. But as I was fully invested and had no spare cash lying around. Hence, I could not take advantage of the opportunity financially by averaging down.

Trading is not for you, if you don’t know what you are getting into

Almost everyone starts off as a trader. Almost no one starts investing with the mindset to hold an investment for years. The problem starts when you get lucky with a few trades and think trading is easy.

When investing, remember that Rome was not built in a day. When trading, remember Hiroshima and Nagasaki were destroyed in one.

Vijay Kedia, Veteran Investor

But that’s not to say that making money by trading is not possible. Trading like long-term investing has lots of nuances and there are a lot to be studied and understood. One must know this before becoming a trader.

Mutual Funds Sahi Hai

The aim of investing in equities is to generate wealth over time, and mutual funds do just that. But they do it with much less risk than individual stock picking. MFs are operated by professional money managers, who allocate the fund’s assets and attempt to produce capital gains or income on your behalf.

The Mutual Funds Sahi Hai campaign had a huge positive impact on demystifying mutual funds in India. This led to a lot of investors seeking Mutual Funds as an investment tool, especially through a Systematic Investment Plan. With the flexibility and options it offers, there is a fund for everyone!!

Mistakes

Not diversifying enough

The saying “Don’t put all your eggs in one basket” seems like such a cliche. But the truth is cliches work. Diversifying with respect to investing is a risk management strategy that limits the exposure to any single asset or risk. An example of not diversifying would be stuffing your portfolio with a lot of sector specific stocks.

There are various types of diversification even within investing, some of them are among:

- Different sectors

- Different countries

- Different asset classes/instruments

Not exploring other instruments

Investing in equities is not the only form of investment, there are various other avenues. These includes:

- Bonds

- ETFs

- REITs

- Commodities such as Gold, Silver

With the unpredicable nature of the markets, it is always in the best interest that you diversify beyond equities. Also, a mixture of multiple asset classes greatly help in reducing the volatility in one’s portfolio.

Portfolio churning

Portfolio churning is in simple terms nothing but “over trading” with the expectation of better returns. If your stock picks are into decent companies with a proven track record, portfolio churning only helps the broker to rake in additional income in terms of commissions and brokerages from your returns.

Example: My very first investment, on day one, was into 6 companies, which I have sold off at various timings. I checked for this article, what would that holding have returned if I had still continued to hold on to them even today. Surprisingly, the combined returns from those six holdings is not much different from the returns from my current holdings. Not to mention all the savings from the various fees, brokerages and tax paid while buying and selling in the second case.

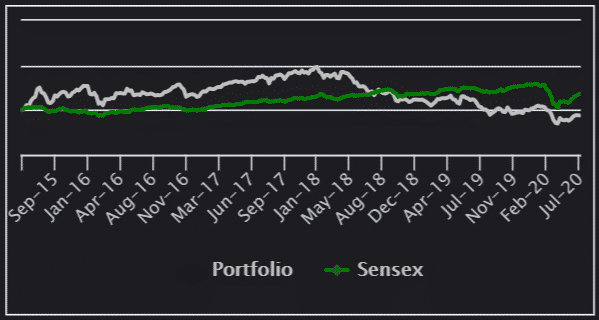

You can only beat the market, if you first match it.

It’s only natural that one aims to generate alpha. I.e. the returns one generates over the returns generated by the benchmark. However, what you forget is the fact that you can only beat the market, if you first match it.

In my initial days, with the aim of “beating the market” I started betting on riskier bets, in hopes of better returns and to some degree found success. But as the Warren Buffet saying goes, “Only when the tide goes out do you discover who’s been swimming naked.” This was exactly what happened when the market cycle took its course and my riskier bets got exposed.

The simple learning from the above chart is that, numbers wise, I would have been far better off just investing in a Sensex ETF or Index fund instead of taking the risk and effort of finding individual stocks and investing.

Investing in Penny Stocks

We should read the mistake of investing in penny stock in conjunction with the learning “Don’t judge a company by its share price” Nearly for the entire first year, I never invested in a company with a share price over Rs 1000 due to the misunderstanding mentioned above. Also, my google searches would be along the following lines: “Best stock under Rs 50/100/200” This is not to say that there are no good stocks under 200, but a flaw in the thought process while picking stocks.

Conclusion

The first five years of one’s investing journey is barely just the beginning. But, all the mistakes, experiences and lessons over this time makes him a better investor from 5 years ago. If you want to learn the craft, make mistakes and make mistakes in the beginning, when the stakes are low.

A man should never be ashamed to own he has been in the wrong, which is but saying… that he is wiser today than he was yesterday.

Alexander Pope – English Poet

I’m sure you too might have had some of these experiences and have came to your own conclusions. Let me know in the comments what are some of your key takeaways from your investing experience. If you found this article interesting, you might also like my article Investing, Why should you start now. Also, don’t forget to subscribe to our newsletter to receive the latest updates on our latest articles.

Announcement: Myself along with 2 of the most passionate guys out there, Padmadip Joshi and Gokul G Kumar have launched a podcast series: Conversations with Reinforced Engineers. Do check it out here (YouTube) or on Spotify by clicking the web-player below if you haven’t already. The podcast is also available on all the leading podcast applications.

Excellent read Krishna 👌If possible do share a detailed guide for your next blog for the beginners who wish to start investing from scratch highlighting the mistakes one should avoid and be a better investor from the start based on your experience.

Thank you, Navneet.

Sure will give it a shot!!

[…] my blog for the first time? Check out my last blog article here. Also, feel free to share your thought in the comments […]

Great content with rich experience brother. I would like to know how to divide our income into different means like, If a person has 50k /month income, So, how to divide for expenditures, emergency funds, investments in equity, commodity, MF, insurances, loans and all those. I would like to have your ideas and guide int his topic..!!!

Thank you for sharing your thoughts.

Will surely get to it in the coming days!!

[…] my blog for the first time? Check out my last blog article on my investing lessons here. Also, feel free to share your thought in the comments […]

[…] My other articles on Investing: Investing: Why should you start now?, What I learned after 5 years of Investing […]